Capitec Bank is one of South Africa’s most recognizable brands, the largest retail bank with more than 15 million active clients.

They are known to focus on providing accessible and low cost banking services to clients via the innovative use of technology, in a manner that is convenient, simplified, and personalized.

10 Most Impressive Mega Projects Happening In South Africa

According to stats from the bank, as many as 180 000 new clients are recorded every month. Judging by the numbers, its clear that Capitec is the most loved banking company in the country.

But how did the company start? what’s the story behind it? how big are they? And what are some lesser known facts about Capitec?

In this article, we’ll explore how Capitec became the largest retail bank in South Africa in an industry filled with big players of over 100 years, and accumulate a market capitalization of over R162 billion.

10 Brands That Most South Africans Use As Generic Names For Products

Background

Established in Cape Town on the first of March 2001 by 3 South African businessman:

- Michiel Le Roux, an LLB graduate, and former executive of Boland Bank, a small regional bank in Cape town’s hinterland.

- Riaan Stassen, a Chartered Accountant and former head of operations at Boland Bank.

- And lastly, Johannes Mouton, the founder and chairman of PSG Group.

Initially started as a micro lender, with loans mostly between R50 and R1500 in size, at an average rate of 22% per month, compared to an industry norm of 30%, attracting low income earners and the unbanked.

WATCH|| South Africa’s Most Powerful Dam, The Gariep Dam

By then, Capitec employees would do marketing on the streets, station, and taxi ranks handing out flyers to each and every person promoting the bank.

The founders identified four key values: SIMPLICITY, TRANSPARENCY, ACCESSIBILITY & AFFORDABILITY.

If we will have a single account, all our customers will get a gold card. And we offer exactly the same, where poor people are not going to stand in the queue and rich people sit in the lounge. Everybody will get treated exactly in the same way.

Riaan Stassen

While at Boland Bank, it was then when Michiel discovered that banking was ran by old systems and asked himself, why do banks close at 3:30 pm???

Then the founders had an idea in mind of a very basic bank, which they would keep simple. The bank was listed on the JSE Securities Exchange on the 18th of February 2002.

Stop Having Fears of Downgrading Your Lifestyle, It’s Completely Okay

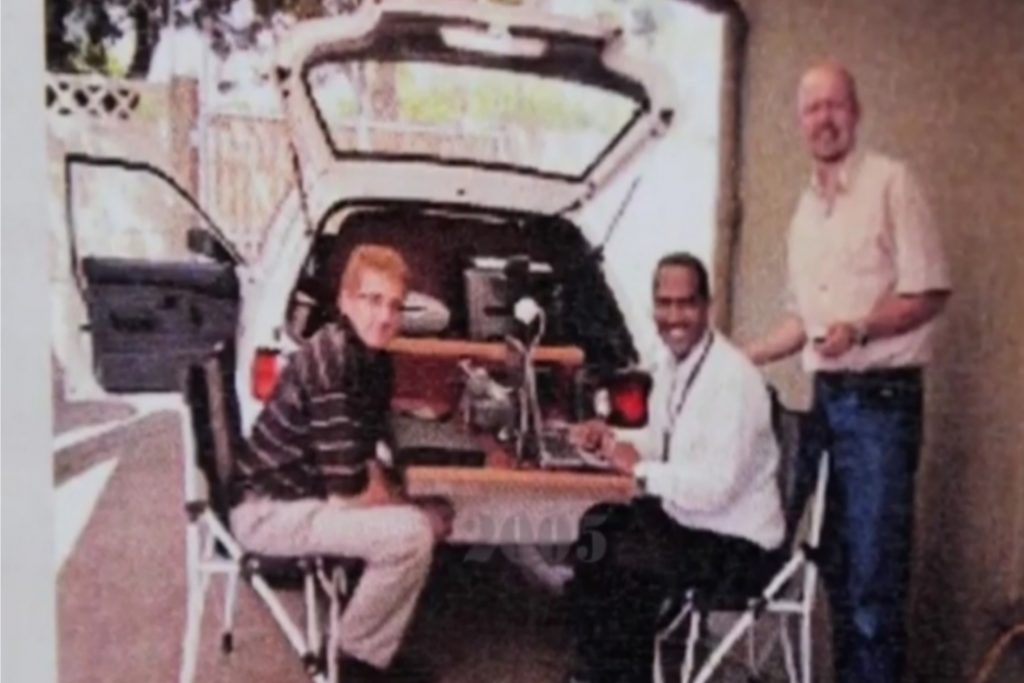

In 2005, Riaan Stassen, the then CEO, wanted the bank to go to the people, so they bought a Toyota Taz, and built a consultant station into the boot of the car. This was a highly secretive project, with only 8 people knowing about the “bank in the boot of a car.”

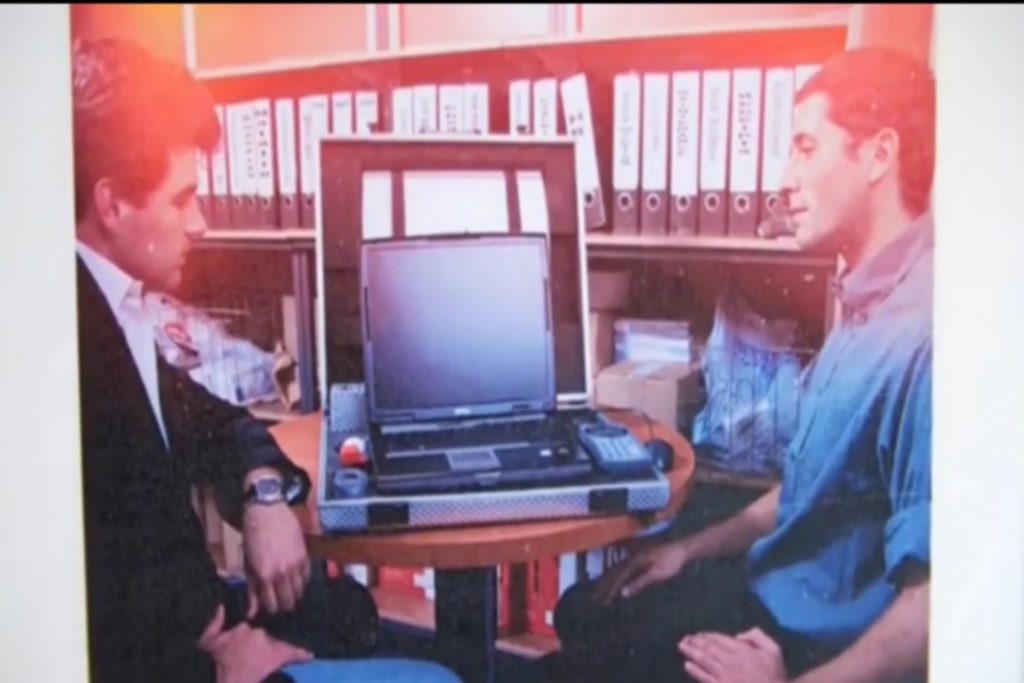

After that, the team wanted to make banking more portable, new innovation saw a computer being built into a silver aluminum case that was carried around to access the people wherever they were. The guy who would carry the case was called the “suitcase man.”

The suitcase man was making mobile banking on site, possible to anyone who required low cost, and simplified banking.

50 South African Brands That Changed Their Names

During the same period, the bank had acquired over 350 000 clients, with 251 branches, and 180 ATMs countrywide, conveniently placed in shopping centers or near commuter points.

By the end of February 2010, the bank had grown to a total number of 2.1 million active clients, which was 11% of total banked individuals in South Africa then.

Because of their commitment to the 4 principles, Capitec has managed to execute some incredibly bright ideas over the years.

Having just celebrated 20 years in style by doing things differently to traditional banks, Capitec has achieved astonishing growth, and is now the largest consumer retail bank in the country, with over 15 million active clients, 14 000 employees, 852 branches and 2380 ATMs countrywide.

Richard Maponya’s Top 10 Rules For Success

What Makes Capitec Bank Different??

Capitec branches operate differently from traditional banks, when you enter a Capitec branch, you notice a few things:

- First of all, its easy to get into, there’s no big security barrier, and that’s because there’s really no cash on the premises.

- Secondly, the absence of queues. And that’s because you take a ticket when you enter, which you will be called once its your turn.

- Lastly, when people are helped by consultants, they’re not facing a window or a desk, they sit side by side with the consultants, looking at the screen together, and the processes are paperless.

So in general, the branches don’t have an intimidating banking atmosphere. They look more like retail shops. Another aspect of the Capitec model that differentiates it from other banks is its opening hours.

The majority of its branches are open till 6pm, because the person whose working from 8 to 5 can’t go to a bank during that time, so Capitec created that convenience to make sure people handled their banking affairs even after work.

The Insane Story of Podcast & Chill With MacG

Mercantile Bank

On the 7th of November 2019, Capitec acquired control of Mercantile Bank, a small and medium enterprise bank. It’s currently ran independently from Capitec.

“Our plan is to grow Mercantile Bank into Capitec’s Business Bank, we believe this will create exciting opportunities for both Mercantile and Capitec employees,”

Headquarters

The same year saw the construction of the company’s new headquarters – nicknamed iKhaya – in Technopark, Stellenbosch.

Designed by dhk architects, the three-storey superstructure wraps around itself, creating a ‘doughnut’ shape and forms a central triple-volume atrium – an internal ‘social spine’ at the heart of the building.

Employees began moving in the new head office campus during March 2020, with world class working spaces for more than 1900 employees, including 56 meeting rooms.

10 Interesting Facts You Didn’t Know About South African Property Billionaire, Dr Keith Bothongo

Graduate Programme

To help create employment opportunities, and discover talented graduates and innovative thinkers who share the company’s values, Capitec launched the Graduate Development Program in 2016.

The company receives an average of 500 000 job applications each year, and to manage this volumes optimally, they are supported in the first screening phase by technology, and candidates who meet the minimum requirements are progressed to the next phase of the process.

From An Old-School Farm To A Farming Conglomerate: The Inspirational Story of ZZ2

Awards

Capitec has won numerous awards, including:

- Best bank in the world by Forbes World’s Best Bank.

- Sunday Times Top 100 Companies award in 2018.

- Kantar Millward Brown award for the most innovative brand.

- Lafferty Top 500 banks worldwide.

- BrandsEye’s South African Banking Sentiment Index 2018 for most loved bank on social media.

And many others

How Ian Fuhr Took Sorbet From An Idea To A Multimillion Rand Franchise

Philanthropy

Capitec takes part in philanthropic efforts in education.

For example, they proudly sponsor Quantify Your Future, a career advice platform for students interested in analytical careers, and also have a bursary program within Capitec.

The company launched employees volunteer program, to support and encourage employees to give back to their communities as a group or individuals.

Through enriching lives and helping their clients live better. Capitec has revolutionized the South African banking industry in just 20 years, there is no any other person who can put it better than Capitec’s own Head of Brand Marketing:

If you have a dream and a vision, and you work at it, you can realize it. It doesn’t matter whether your industry has been dominated by five players for 150 years, you can still come in and you can make a difference, and you can rattle that market.

And you can be able to even grow the size of the market. Get people who were previously excluded, included.

Get South Africa’s latest entrepreneurial or business success stories delivered right to your inbox — Sign up to Entrepreneur Hub SA’s newsletter today ⬇️⬇️⬇️

Your articles are extremely helpful to me. May I ask for more information?

Thank you for your articles. They are very helpful to me. May I ask you a question?

With havin so much written content do you ever run into any issues of plagorism or copyright infringement? My site has a lot of exclusive content I’ve either authored myself or outsourced but it looks like a lot of it is popping it up all over the web without my permission. Do you know any techniques to help protect against content from being stolen? I’d really appreciate it.

I’ve come across that now, more and more people are now being attracted to cameras and the subject of pictures. However, as a photographer, you will need to first shell out so much period deciding the exact model of video camera to buy along with moving from store to store just so you may buy the most affordable camera of the brand you have decided to pick out. But it would not end there. You also have to consider whether you should obtain a digital video camera extended warranty. Many thanks for the good tips I obtained from your website.

I was recommended this web site by means of my cousin. I am no longer positive whether or not this publish is written by means of him as nobody else recognise such precise about my problem. You are wonderful! Thank you!

청도페이스라인출장

Porn site