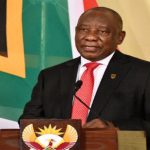

South Africa’s rand and government bonds rebounded on Friday, this came after chairman of the ANC rebutted speculation that President Cyril Ramaphosa was considering resigning over accusations he may have violated the constitution.

Regardless of his plans to fight back, Ramaphosa’s political future still hangs in the balance, with the NEC(National Executive Committee) of his governing party(ANC) set to meet and discuss the report in Johannesburg on Sunday afternoon.

Thursday’s steep market sell-off relented on Friday, with the rand up 1.6% at R17.27 against the dollar, although that was still below the levels at which it had been trading before the speculation about Ramaphosa.

On Thursday, the rand plunged more than 4% at one stage, after News24 reported that Ramaphosa was likely to resign within hours, before cutting losses to end about 2% weaker.

Rand volatility gauges have also soared, more especially the highly-sensitive 1-week gauge which stayed on Friday at its highest level since the peak of Covid fears in early 2020.

“The knee-jerk reaction yesterday was to just sell the rand but given that Cyril Ramaphosa is not resigning immediately… plus given that he has a more business-friendly profile than many other(s), markets are pinning their hopes on him staying in office.”

said Per Hammarlund, chief emerging markets strategist at SEB in the Swedish capital of Stockholm.

The country’s bonds also staged a partial recovery. Longer-dated sovereign dollar-denominated bonds that fell furthest rebounded the most, with the 2052 maturity rising 1.3 cents to 87.012 cents in the dollar, data from Tradeweb showed.

The local 10-year benchmark also recovered from some of Thursday’s losses, which were the biggest since the covid-19 market rout of March 2020, with the yield down 30.5 basis points at 10.635%. Shares in Johannesburg also fell despite having risen slightly in the previous session. The all share index was down 0.75% to 74.458 points, while the Top-40 index was down 0.8% to 68.316 points. An index of bank shares which also suffered losses on Thursday, rebounded by 2.3% at 9.858.

Ramaphosa’s spokesman, Vincent Magwenya, told reporters the president still had “all options on the table” over the panel’s Phala Phala report, and was still consulting with a broad range of people over the next steps.

The panel, established by parliament, investigated accusations that thieves found and stole millions of dollars of cash stuffed into sofas at Ramaphosa’s Phala Phala game farm in early 2020.

The theft, which was reported by Arthur Fraser in June, has raised questions about how President Ramaphosa acquired the money and whether he declared it since he came to power on the promise to fight graft.

The president has said a much smaller amount of money – the proceeds of game sales – was taken. He has denied any wrongdoing and has not been charged with any crimes.

On Friday, Gwede Mantashe told media that the party had a responsibility to reassure markets and society, pointing to the rand plunge of the previous day as a reason for Ramaphosa to stay on.

Get South Africa’s latest entrepreneurial or business success stories delivered right to your inbox — Sign up to Entrepreneur Hub SA’s newsletter today ⬇️⬇️⬇️

eBook: 50 South African Entrepreneurs Reveal HOW THEY MADE IT