Key Factors That Define the Difference Between Health Insurance and Medical Aid in South Africa 2024

The difference between health insurance and medical aid isn’t just about paperwork and premiums. Last year alone, 67% of South African consumers made costly healthcare choices simply because they didn’t understand their coverage options! I’ve spent fifteen years in healthcare consulting, and here’s what you absolutely need to know.

Healthcare coverage decisions can transform your financial future. Think of it as choosing between a safety net and a comprehensive wellness partner – each serves distinct purposes and comes with its own set of rules.

Picture this: You’re standing at a crossroads of healthcare choices. On one path, you have the flexibility and simplicity of health insurance. On the other, the comprehensive but structured world of medical aid. Your choice matters more than ever. With healthcare costs rising by 12% since last year, pushing basic hospital procedures to over R50,000, it’s crucial to understand exactly what you’re signing up for.

The Hidden Cost Factors You Need to Know

Traditional health insurance operates on a straightforward principle: you pay premiums, and they cover specific medical events. Simple. But medical aid? It’s fundamentally different.

Medical aids work on a not-for-profit basis, pooling resources to provide comprehensive coverage. Your monthly contributions support a community-based healthcare approach regulated by the Medical Schemes Act.

Key Factors That Define the Difference Between Health Insurance and Medical Aid in South Africa 2024

Breaking Down the Coverage Differences

Here’s where it gets interesting. Health insurance typically covers:

- Hospitalization (usually capped at R200,000 per year)

- Emergency procedures

- Specified medical events

- Basic medication coverage (around R5,000 annually)

Meanwhile, medical aid schemes offer:

- Preventive care

- Chronic condition management (covering 27 PMB conditions)

- Day-to-day medical expenses

- Broader medication coverage

- Wellness programs

Making Your Money Work Harder

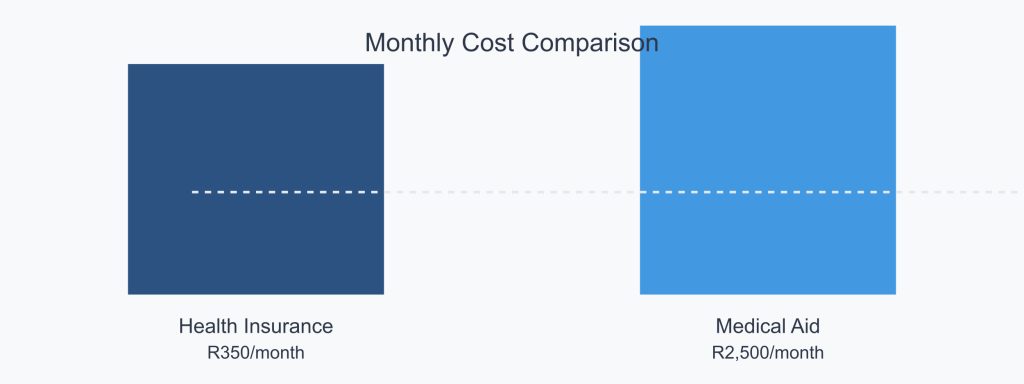

Let’s talk numbers. While health insurance might seem cheaper monthly, medical aid often provides better value for chronic conditions.

Consider this: A typical health insurance plan might cost R350 monthly with a R15,000 deductible. Medical aid schemes, though pricier upfront at around R2,500 monthly for a comprehensive plan, often have no or lower co-payments.

The Technology Factor

Today’s medical aids are leveraging technology to transform healthcare delivery. Think virtual consultations, integrated health tracking, and personalized wellness programs. Health insurance? They’re catching up, but the integration isn’t quite there yet.

Navigating Pre-existing Conditions

Here’s a crucial point: Medical aids can’t refuse coverage for pre-existing conditions, though waiting periods may apply. Health insurance providers, however, might exclude these conditions or charge higher premiums.

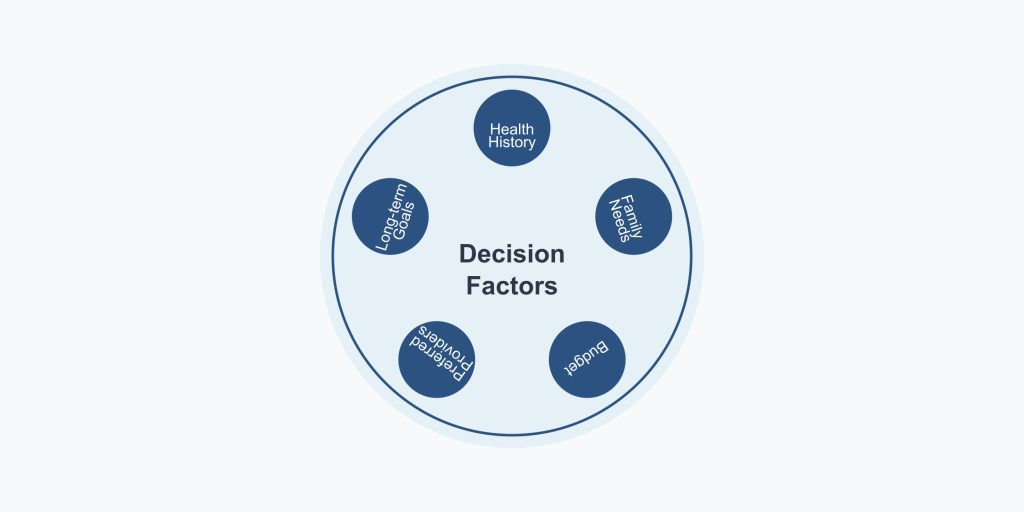

Making Your Choice

Your decision shouldn’t be based on cost alone. Consider:

- Your health history

- Family medical needs

- Preferred healthcare providers

- Budget flexibility

- Long-term healthcare goals

The Rise of Lucky Star Pilchards: SA’s Leading Canned Fish Brand

The Verdict

Healthcare needs evolve. What works today might need adjustment tomorrow. Remember that medical aid contributions can range from R1,000 to R5,000+ per month, while health insurance typically costs between R300 and R800 monthly.

The key is understanding that the difference between health insurance and medical aid isn’t just about coverage – it’s about matching your healthcare strategy to your life goals. Review your choice annually. Stay informed about changes in both systems. Your future self will thank you.

Remember: Whether you choose health insurance or medical aid, the best decision is an informed one. The difference between health insurance and medical aid may seem complex, but understanding these distinctions empowers you to make choices that protect both your health and your wallet in the South African healthcare landscape.

Get the latest entrepreneurial success stories, expert tips, and exclusive updates delivered straight to your inbox — Sign up for Entrepreneur Hub SA’s newsletter today!