Pineapple recently announced an R80 million investment through Series A round of funding.

The insurtech startup was launched in mid-2018 by Matthew, Ndabenhle and Marnus, with the aim of solving the trust issues involved in the insurance world.

According to Van Heerden, Pineapple is on a journey to building the lost trust between the insurer and insured. The startup will achieve this by providing top-notch customer experience, with the aid of cutting edge technology and a groundbreaking model.

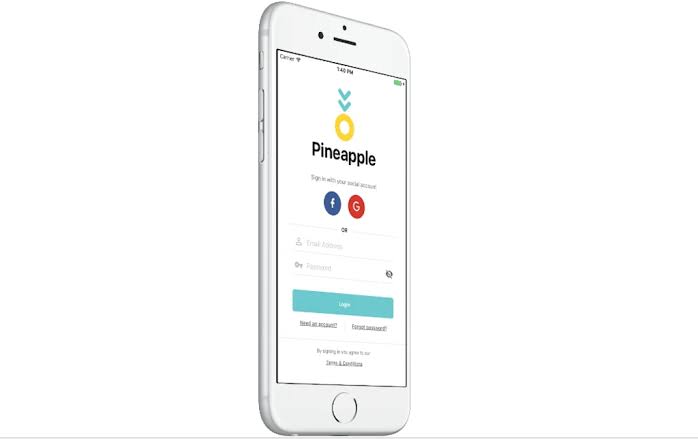

The exciting thing about Pineapple is that one can insure their car or belongings in less than 90 seconds using either the app or website.

FUN FACT|| The Kenyan Game That Inspired The Name of Mofaya Energy Drink

Background

To understand the story of Pineapple more clearly, let’s take it back to 2016, when in an effort to find a groundbreaking model in the insurance industry, Matthew Elan Smith(Actuarial Scientist), Ndabenhle Junior Ngulube(Developer) and Marnus van Heerden(Accountant) got together as part of an innovation competition run by Hannover-Re.

The competition ran for 6 months and it was out of their innovation spot in Rosebank, where the story of Pineapple began.

How Sipho Maseko Revived Telkom From The Dead

The team’s “Dark horse” phase of creative thinking planted the seeds of what would later be known as Pineapple.

They set their sights to changing ways in which the insurance world was conducted in the country, with an entirely new innovative model that aimed to achieve affinity, fairness and simplicity to reduce costs, increase profits and deter fraud in an aim to produce more value from an insurance policy than the traditional old model.

How This Couple Quit Their Jobs & Founded SweepSouth, A Startup Worth Billions

What Makes Pineapple Unique??

What makes Pineapple different from the pack is that it only charges a fixed fee and brings back unutilised premiums, year after year. The main aim of this is to avoid the perceived conflict of interest between insurers and their clients.

Normally in traditional insurance model, customers pay premiums into a central pot, which is then used to settle claims but in the end, the insurance takes the profits that are left.

On the other hand with Pineapple’s model, customers still contribute a standard premium which is sent to their individual Pineapple wallets.

Why Ramaphosa’s Ankole Cattle Sells For A Whopping R640 000

These wallets will in turn form a network of wallets and claims are paid from this wallet network. Whatever amount of money remaining in the overall pot, is paid back to customers at the end of the year.

In late 2016, the team presented the business model of Pineapple in Germany and throughout the 1st half of 2017, worked tirelessly to refine the business structure and lay all the regulatory and technical groundwork to make Pineapple from a concept on paper to a reality.

They started the development of systems in August of 2017, as well as securing funding and on top of that, got licensed by the Financial Services Board.

In the beginning of 2018, the team started out testing their prototype model by taking over a 1000 users, who’s feedback helped them enhance the usage of the platform. The response helped them build what people wanted as opposed to what they initially thought they wanted.

How Donald Valoyi Quit His Job At FNB & Launched The Now Successful Zulzi

After a few months of testing and iteration with invite-only clients, Pineapple officially launched to everyone on 27th of July 2018. To introduce themselves in the insurance community, they handed out 35 000 Pineapple’s at intersections across South Africa.

Pineapple’s initial service allowed people to become members and cover the things they owned with a snap of a picture.

In 2020, Pineapple reached over 50 000+ clients. Registered clients constantly made suggestions to the team and as time went on, they launched a groundbreaking vehicle insurance, which was underwritten by Old Mutual Insurance.

How Amina Abrahams Went From Being Retrenched To A Multimillionaire

In the first 6 months of 2021, Pineapple has shown a 200% growth. This proves that customer insurance transactions behaviour is beginning to shift online, mostly speeded by the impact of Covid-19 pandemic and its lockdowns.

With the recent funding the startup managed to secure, things are looking bright. The company will be able to employ new developers and marketers to propell its services forward.

Please tell me more about your excellent articles

Have you ever considered about including a little bit more than just your articles? I mean, what you say is important and all. However just imagine if you added some great pictures or videos to give your posts more, “pop”! Your content is excellent but with images and video clips, this website could definitely be one of the very best in its niche. Very good blog!

I have been checking out a few of your stories and i can claim pretty nice stuff. I will surely bookmark your site.

I would like to thank you for the efforts you have put in writing this site. I’m hoping the same high-grade site post from you in the upcoming as well. Actually your creative writing skills has encouraged me to get my own site now. Actually the blogging is spreading its wings fast. Your write up is a good example of it.

One thing I would really like to say is the fact before obtaining more computer system memory, take a look at the machine into which it could well be installed. In the event the machine is running Windows XP, for instance, the particular memory limit is 3.25GB. Adding greater than this would purely constitute just a waste. Be sure that one’s mother board can handle an upgrade amount, as well. Thanks for your blog post.