Many South Africans are probably familiar with the OK brand as a suburban furniture store chain, and food retailer.

But how many remember that OK was once South Africa’s largest retailer, and the first-shop choice for thousands of SA shoppers?

Or the fact that this giant business with over 12000 employees, was sold to its rival Shoprite for a measly R1?…..YES you’ve read that right, 1 freaking rand.

OK RISES

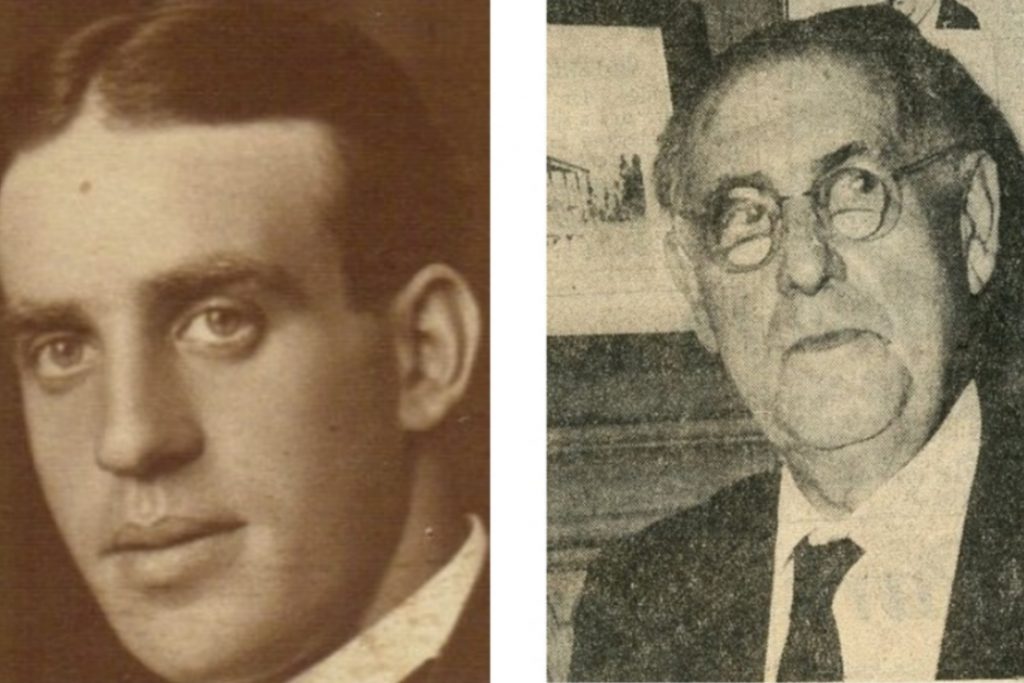

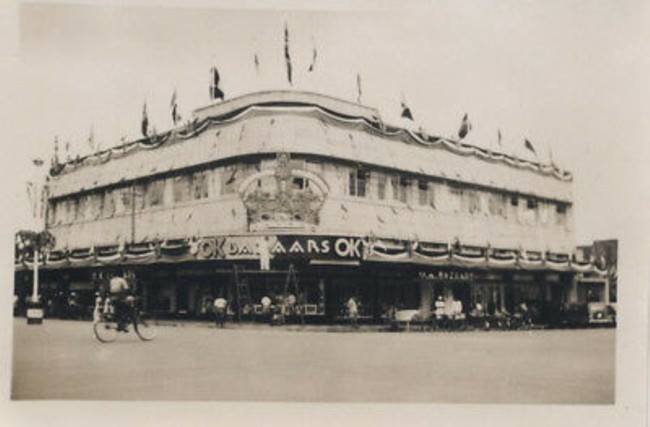

In 1927, Michael Miller and Sam Cohen opened the doors to the first OK store on a prime site in Eloff Street, Johannesburg.

Their main aim was to pioneer the self-service concept in SA. Over the next 40 years, they opened over a hundred OK stores in the CBDs of towns and cities across the country.

By the early 1970s, OK was the preferred shopping choice for thousands of South Africans, and the country’s most trusted retail household brand.

SAB ACQUISITION

But the thing is, OK was a family business and vulnerable to a takeover.

It’s market share, size, customer base, and profitability attracted investors. In 1973, South African Breweries(SAB) acquired the controlling stake of the Miller and Cohen families, in what was then the largest retail transaction in SA history.

3 months later, South Africa’s first suburban shopping mall was opened in Sandton near Johannesburg, this marked the time when the face of retailing in the country began to change.

THE FALL

South African shoppers who were used to visiting the “high street shops” changed their buying habits, because shopping malls exploded across South African cities and towns during the late 1970s and early 1980s.

This prompted many retailers to cancel their CBD leases, in favor of moving to the malls, and revamping their business models.

New retail offerings started emerging, which focused mostly on product ranges, specialising in clothing, groceries, toiletries or furniture.

Profits of the old-style retailers in the CBDs plummeted heavily, and many high-end department stores closed down.

Despite the country’s central business districts going down, OK Bazaars still didn’t move to the malls. The company remained a high street general dealer, offering a range of clothing, groceries, home appliances, and furniture.

For nearly 20 years, in spite of falling profits and declining turnover, OK’s management still carried on running their stores in the country’s declining CBD’s.

In 1992, OK’s annual report blamed a 27% drop in earnings on the “escalating unemployment, current recession, and continued socio-political unrest” – the same year saw a competitor’s earnings growing exponentially.

SHOPRITE HOLDINGS

In 1995, after OK reported a R30 million operating loss, SAB put the company up for sale. Over the next 3 years, international and local buyers came by to look, but no deal was ever struck – meanwhile the losses continued.

In 1997, OK’s 22 Hyperamas and 187 departmental stores were on the brink of insolvency, but Shoprite Holdings came with R1 to the table, and bought the company.

As you’d expect, the value of the transaction led to questions from some of the SAB shareholders – they asked if whether they should have bought OK in the first place, or were they wrong to just give the business away for R1?

At the same time, there were speculations that Shoprite had bitten off more than it could chew.

The problem was that OK was already tied to long term leases in the CBDs of many towns in the country, and its new owner was required to take over responsibility for millions due to suppliers, in return for inventory that was suspected to be slow moving and obsolete.

WHITEY BASSON

The challenge of recovering OK Bazaars from the dead was taken up by then Shoprite’s CEO, Whitey Basson. Whitey was instrumental in building Shoprite from just 8 small chain of grocery stores in the Western Cape, to a national key retailer.

When he began working on the reviving process, Whitey was unimpressed with the structure of OK’s leadership and team culture.

According to Whitey, there was no integral respect, love, guidance or working togetherness between the staff, shareholders and management. As a result, decisions that were taken had never benefited the business, but rather the interests of one or two groups.

DIAGNOSIS

Upon dissection, Whitey found several operating problems:

- OK was flying blind, as there was no credible information systems.

- Lack of financial control:

with 14K employees on the payroll, the retailer had no proper clock card system or other process for monitoring attendance and timekeeping. - Operating Costs Were Too High.

OK was the only retailer that ran its own advertising department instead of outsourcing to an agency. Its advertising department employed 120 people, whereas Shoprite, whose turnover was 5 times higher than OK’s, had only 6 people. - Whitey reviewed OK’s retail productivity metrics:

- Turnover per employee or employee hour for staff.

- Turnover per square metre for all stores.

- Stock turn by unit and department for inventory.

After these key operating figures were revealed, it was apparent that OK’s 3 major resources – merchandise, stores, and people, were under-utilized, badly managed, and poorly controlled in comparison to Shoprite.

There was evidence of 3 classic symptoms of bad management:

- firstly, an autocratic, complacent inflexible leadership, with no team culture.

- Secondly poor governance in the form of a passive board, doggedly pursuing wrong strategies and not reacting urgently to losses.

- Lastly, a weak finance function with no information systems, no daily operating measures, inadequate attendance controls, weak cost management, and poor or absent forecasting.

PROPOSED SOLUTIONS

From these findings, Whitey concluded that OK couldn’t be fixed as a separate stand-alone business. Rather, it had to be broken-up, and absorbed into the Shoprite system.

There were many opportunities for synergies:

- Firstly, both Shoprite and OK had similar target markets and product offerings.

- Shoprite’s supervisors, managers, and buyers had capacity to absorb the OK operations in each region.

- Key functions at OK such as merchandising, accounting, buying, information technology, and personnel were able to be merged with Shoprite’s.

- Shoprite’s systems and tight controls could be installed in the OK stores in every region across the country.

RISE AGAIN

Whitey acted swiftley and decisively:

- The advertising department was closed and integrated with Shoprite.

- Most of the senior staff were offered retrenchment packages.

- Improved controls and information systems reduced shrinkage by over R100 million.

- Loss making stores were either rebranded or closed.

- The non-core OK Furniture was set new targets with the implied promise of a future listing

After 2 years of taking control, Whitey returned OK to profitability once again, with pre-tax earnings of R5 million.

The OK brand still exists to this day – unfortunately, as a shadow of its former self.