To better understand the story of Tymebank more clearly, let’s take it back to June 2012 when ‘Take Your Money Everywhere’ aka Tyme was officially launched by a small team within Deloitte Consulting headed by Tjaart van Der Walt and Ceon Jonker, as a mobile money remittance operator.

The whole project was funded by the MTN Group, to better their efforts in providing advanced technology to retailers that would enable them to offer local remittance services cheaper to banks.

Richard Maponya|| The Importance of Saving Money & Starting Small

From then on, Rolf Eichweberas entered the scenes as the third official co-founder of the brand.

In November of the same year, Tyme secured a deal with Grobank as their banking partner, with Pick N Pay as a customer.

The main idea was to use mobile money as the conjugate for remittance inside South Africa through both Pick N Pay, and its subsidiary, Boxer Superstores

MTN being the investment partner allowed Tyme to tap much into the company’s customer base and offered them a couple of services for free.

So with 3 partnerships at hand; MTN for customers, Grobank as a banking partner and Pick N Group for cash-in and cash-out services – Tyme built the technology which allowed cash conversion at one till into mobile money and back to cash at the other till for the remittee.

How Amina Abrahams Went From Being Retrenched To A Multimillionaire

By then, Tyme’s core banking system was visible and in order to solidify it, they managed to secure a partnership with Ebank in 2013, to build a low-cost digital bank in Namibia.

In 2014, Tyme was forced to bow out of the joint venture with Ebank, as the company was acquired by Commonwealth Bank of Australia(CBA) in 2015 for R365 million.

The 38.3% stake Tyme owned in Ebank was sold to PointBreak, an investment company in Namibia.

How George Sombonos Turned Chicken Licken Into One Of The Largest Fast-food Outlet In The World

Tyme >>> TymeDigital

CBA mainly bought Tyme for the core banking platform the team had built. CBA’s idea was to use the already existing tech system and build a retail bank.

In 2015, Rolf Eichweberas led the application for a retail banking license at the South African Reserve Bank(SARB). After going up & down for over 2 years, Tyme, now renamed TymeDigital finally secured its full banking license.

During that time, the company continued to solidify its partnership with Pick N Pay, by signing a money transfer deal for a remittance product in May 2016. And also, a 10 year distribution partnership in February 2017.

In late 2017, Tyme dabbled in innovative ideas & started building its black&yellow proprietary kiosks.

On the 17th of February, MTN decided to cancel its partnership deal with TymeDigital due to what they described as “lack of commercial viability”……

……the exodus was followed by Grobank alongside the co-founder, Rolf Eichweberas and numerous other developers.

How Vusi Thembekwayo Went From Being A Wits Dropout To Amassing $600 Million

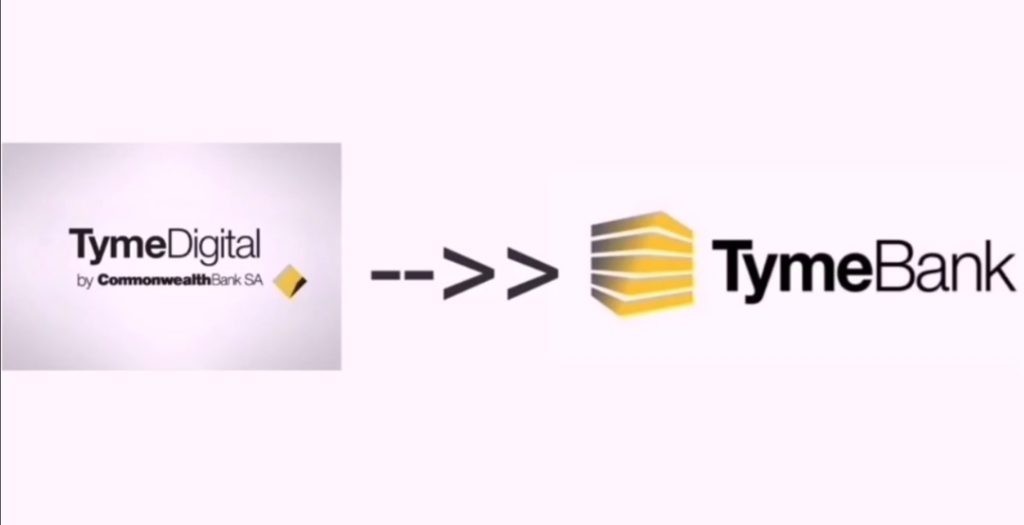

TymeDigital >>> Tymebank

In early 2018, Patrice Motsepe’s African Rainbow Capital(ARC) bought a 10% stake in Tyme Digital from CBA.

In order to focus more on Australia, CBA decided to retreat from international markets. This was a convenient timing for ARC, who immediately bought out CBA’s remaining 90% in September 2018.

TymeDigital was then rebranded to Tymebank. In November, a soft launch was conducted and the reception was positive, as Tymebank ended up signing its first group of customers.

In February 2019, Tymebank officially launched in South Africa, with its EveryDay transactional account being available to customers across the country.

How Brian Joffe Turned Bidvest Into A Multibillion Conglomerate

Since then….

- Tymebank has managed to sign over 4 million customers.

- Voted 2nd best bank in South Africa within 18 months of operation.

- Signed a deal with ZCC, the biggest church in Southern Africa, to simplify the signing up process for the 12 million+ members.

- Will be expanding its services to Philippines sometime this year

- Secured foreign investments from the likes of Tencent, Apis Growth Fund II and JG Summit Holdings.

- Secured a deal with The Foshini Group(TFG) that will allow TymeBank’s financial services benefit TFG’s 26 million customers in South Africa.

Tymebank is currently signing between 3000 – 5000 clients per day and if things continue going this way, it will attain the status of being one of the biggest banks in South Africa.

Wikipedia

founderssauce

thepaypers

Get South Africa’s latest entrepreneurial or business success stories delivered right to your inbox — Sign up to Entrepreneur Hub SA’s newsletter today ⬇️⬇️⬇️