The Shoprite Group is an investment holding company whose combined subsidiaries constitute the largest fast moving consumer goods retail operation on the African continent. Its core business is in food retailing, complemented by furniture, pharmaceuticals, hospitality, ticketing, digital commerce, finance, cellular services, as well as technology.

With a market capitalisation of R131.65 billion, the holding company started from small beginnings in 1979 with the purchase of a grocery chain of 8 Western Cape-based supermarkets for R1 million.

Today the group provides employment to over 152 000 people across its 3152 store operations in 10 African countries including South Africa, Lesotho, Swaziland, Botswana, Zimbabwe, Malawi, Mozambique, Zambia, Angola and Ghana.

With the use of data science and artificial intelligence, Shoprite’s diverse mix of talent has transformed the retail landscape from traditional brick-and-mortar shops to multi-channel platforms where customers can experience frictionless and more personalised shopping.

Shoprite’s ability to leverage suppliers, its superior distribution capabilities and structurally higher than industry margins has translated into higher than industry returns and market share gains over time.

The retail holding company is listed on 4 different exchanges in 3 different countries including the Johannesburg Stock Exchange and A2X Markets in South Africa. The Namibian Stock Exchange in Namibia, as well as the Lusaka Securities Exchange in Zambia.

In addition to the company’s commercial ventures, the Group is committed to sustainability and being a responsible citizen. The Group’s extensive sustainability initiatives reduce the environmental impact of its operations, improve the lives of the communities it operates in and also help develop small suppliers.

Since its inception, Shoprite’s main purpose has always been to uplift lives every day by pioneering access to the most affordable goods and services, creating economic opportunity and protecting the planet.

In order for us to understand the story of how Shoprite became Africa’s number one food retailer, let’s take it back to the year 1964, when Whitey Basson met Christo Wiese at the University of Stellenbosch while they were both staying in Wilgenhof Residence.

During this time, Whitey was studying Accounting while Christo was doing law. Together they shared a common bond and were both staunch supporters of the United Party.

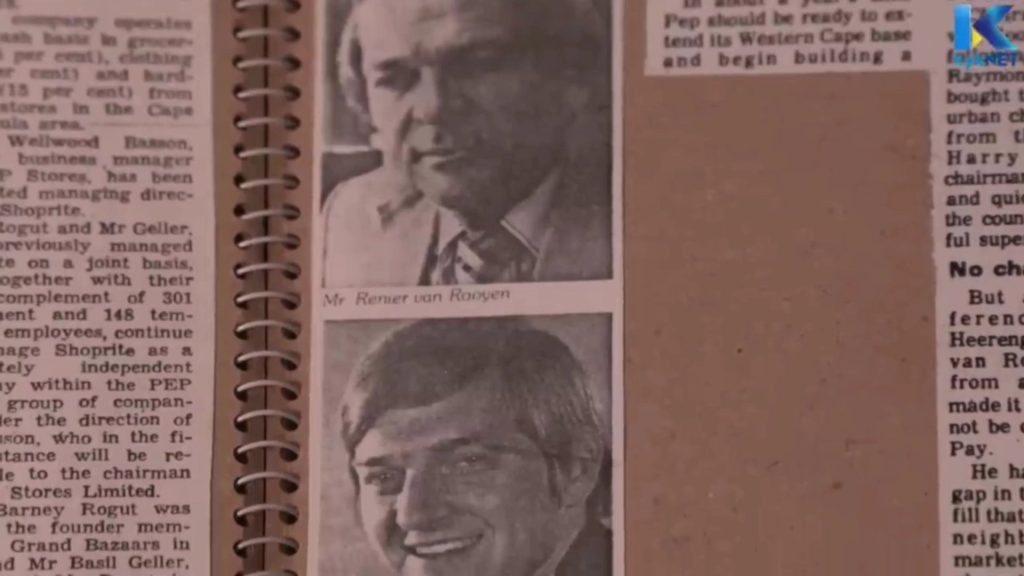

After completing their qualifications, the two friends went their separate ways. Christo became the right-hand man to Pep Stores founder, Renier van Rooyen in 1967, while Whitey went on to serve his CA articles with Ernest & Young.

After writing his final CA exam, Whitey left Ernest & Young in 1970 and joined PWC. In 1974 he was appointed to the Board and remained a member until 2004. Pep Stores was one of the clients the accounting firm worked with.

Van Rooyen was looking to list Pep Stores on the Johannesburg Stock Exchange, and needed a financial manager to help him with the process, Whitey joined him and the clothing retailer was listed in 1972.

During this time, Christo Viese, who was Van Rooyen’s right hand man at Pep, had gone to seek a fortune in the mining industry, so Whitey became what he says was effectively “Van Rooyen’s personal assistant”. This is the period where he acquired most of his retail experience. In 1974, he was elevated to the position of Financial Director & Head of Operations at the tender age of 28.

Whitey had a particular skill that would set him apart as an exceptional CEO later in his life. He was extremely good at negotiating & buying distressed companies. After he heard that Pepkor’s financial statements were being leaked to his rival Sam Stupple, who ran The Half Price Group, a Pepkor competitor in discount clothing, Whitey started a rumour that Pep was going in groceries. Afraid, Sam Stupple applied for a license to beat Pep to the punch but that tactic put the company in financial distress & Whitey bought The Half Price Group for cents on the rand.

At the age of 33, Whitey wanted a new challenge. He believed there was a gap in the market of serving the black population with consumer packaged goods.

Like Pepkor did with clothes by making them affordable to the masses, he wanted to do so with everyday goods & groceries. His strategy was rather than build organically, he would gain scale by buying distressed grocers & refocusing them towards the mass population.

In 1979, Whitey received a call from a friend who told him that a small family-owned food chain called Shoprite was up for sale. He approached Pep kor’s board of directors to get the go-ahead to buy the grocery chain & install himself as CEO of the new company. Pep went on to acquire the chain from the Rogut family in November of that year for R1 million, a far cry from Shoprite’s current market capitalisation. Shoprite brought with it eight stores in the Western Cape and annual turnover of R6 million.

Having established the strategy of focusing on the mass underserved population, Whitey & Shoprite targeted the Northern Cape, Free State & Limpopo as the new markets outside of the Western Cape.

In 1981 Whitey got a new boss at parent company Pekor. The flamboyant Christo Wiese had bought out Renier van Rooyen’s shares & assumed control of Pepkor as Chairman & by virtue, control of Shoprite too. Christo pushed Whitey to grow using his personal wealth & the balance sheet of Pepkor.

Gaining scale in a food retail market dominated by Pick n Pay was one of Whitey’s main objective. In 1984 Shoprite purchased 6 Ackermann’s grocers in a deal that saw Pepkor takeover 34 Ackermann’s Clothing stores from Edgars. By 1986 Shoprite had 33 outlets in various provinces & had an IPO on the Johannesburg Stock Exchange at a valuation of R29 million.

Shoprite was the younger sibling of Pep kor but as a public company, the company hustled & hacked its way to scale. Because of their target market, landlords did not want Shoprite in their malls. Whitey decided if the company was to scale they needed to move away from the malls & establish a presence as free-standing grocery stores in city centres.

The preferred strategy for Shoprite was to grow via acquisitions of smaller grocery chains but when they could not, they targeted free-standing property near city centres.

Whitey knew that their market did not live in towns but on the periphery due to spacial inequality brought about by Apartheid laws. The best way to get their customers is on their way home; in city centres near the taxi rank. Shoprite would amass a portfolio of over 40 free-standing stores in the years to come.

At the turn of the decade, South Africa was still under Apartheid rule but Nelson Mandela was released on the 11th of February 1990. Around that time, Whitey was walking through a Grand Bazaars store, a subsidiary of Metro Cash & Carry. The company was ran by a guy called Carlos Dos Santos. Whitey noticed that some of their fridges were turned off & they only sold coke products.

In the retail world, how full your fridges are determines how much money the store makes because beverages are high margin goods & a profit driver. Whitey called Carlos to buy Grand Bazaars & they made a deal. Shoprite instantly gained 71 more stores.

In 1991, not even a year after buying Grand Bazaars, Whitey had his eye on Checkers, one of the largest upmarket retailers in the country. Whitey was afraid that Raymond Ackerman, CEO of Pick n Pay & South Africa’s version of Sam Walton, would buy it before him.

Ackerman was once the Chief Executive at Checkers before he was fired. Whitey & Christo with the help of Marinus Daling, Chairman of Sanlam, one of South Africa’s biggest insurance companies, orchestrated a reverse merger that saw Shoprite takeover Checkers. A deal worth R55 million.

The deal trebled Shoprite’s size to 241 stores with a staff of 20 000, gave it a national footprint and a presence in major shopping centres. However Checkers also brought immense challenges. At the time of the acquisition, Checkers was on its fifth CEO in 8 years and losing R45 million, which was what Shoprite was making in annual turnover.

Investors took fright at the Checkers deal, wiping 60% off its share price within three months of the announcement. They had underestimated Whitey Basson. Nine months after acquiring Checkers, it was returned to profitability.

Lacking at the time of the deal was the financial muscle to market Shoprite and Checkers as two separate brands. The alternative chosen was to market them under the combined Shoprite-Checkers brand.

After 1994 Shoprite expanded aggressively in the SADC region, the first cross-border thrust happened in 1995 when a store was opened in Lusaka, Zambia. Today Shoprite has a sprawling – and profitable – presence across numerous African countries.

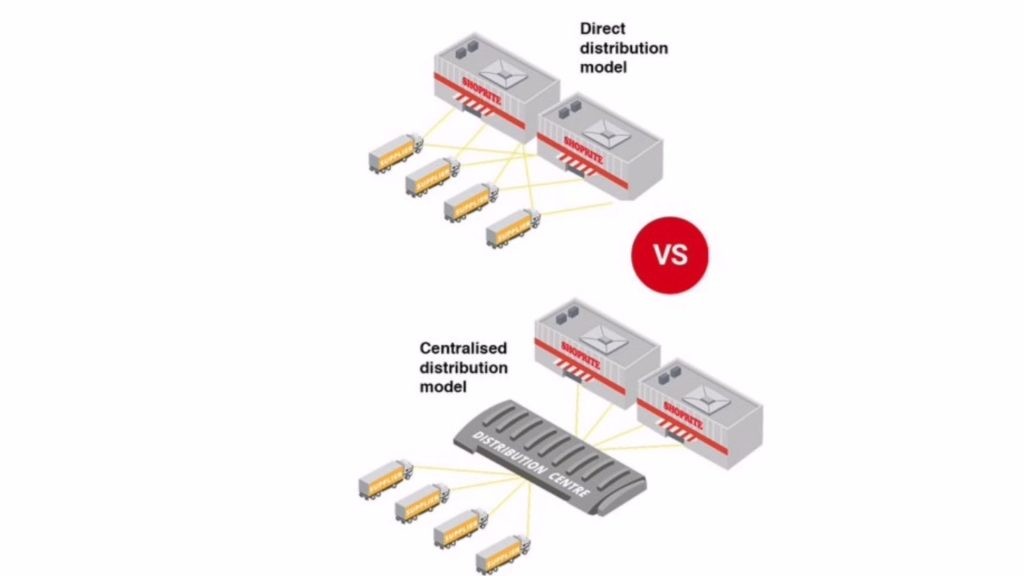

During the same period, Whitey bought a distribution centre & technology company called Sentra which proved pivotal for Shoprite. They learnt how distribution centres worked with small convenience stores.

Sentra served about 550 owner-manager supermarkets at the time and marked Shoprite’s entry into franchising and the smaller convenience-store segment.

It also provided a big boost to the group’s capabilities in centralised distribution, a concept Whitey says was adopted “from day one” by Shoprite.

Not yet satisfied, Whitey plunged into another acquisition carrying huge risks: the legendary 1 rand deal with South African Breweries to buy OK Bazaars, once SA’s largest retailer.

For SAB, selling OK for R1 was an act of desperation. SAB had pumped R1 billion into OK since delisting it in 1994 but could not stem the losses which totalled 185 million rand between 1994 and 1997.

At the time of the deal, OK was losing 1 million rand every working day. On an annualised basis, the losses exceeded Shoprite’s net profit in the year to June 1997 of R181 million by about R120 million.

Whitey and his team made swift work of OK’s turnaround and in its year to June 1998, Shoprite reported a 43% rise in headline earning per share. Despite the OK deal’s scale, Whitey didn’t really consider it as big of a challenge as compared to Checkers because they had more management in place and also had the benefit of experience gained in the Checkers acquisition.

OK gave Shoprite the real scale Whitey had always wanted, adding 139 OK supermarkets, 18 OK hypermarkets, 125 OK Furniture and 21 House & Home stores. About 33000 OK employees were added to Shoprite’s existing staff complement.

The deal also put Shoprite decisively ahead of archrival Pick n Pay. Boosted by consolidation of OK for eight months, Shoprite’s turnover in the year to June 1998 jumped from R9.4 billion the previous year to R14.6 billion in its year to February 1998 while Pick n Pay’s turnover stood at R10.97 billion.

With integration, OK’s supermarkets were rebranded as Shoprite stores and OK Hyperama stores converted to Checkers Hyper stores at a total cost of R373m. The OK brand was retained for the OK Franchise Division housing smaller convenience orientated stores while the OK Furniture and House & Home branches were consolidated into a single OK furniture division.

House & Home eventually separated from OK and became the flagship brand of the group’s furniture division. House & Home offers homeware, furniture, electrical appliances and more at affordable prices. These stores present affluent customers with a wide choice of products along with a convenient shopping experience.

Today there’s over 50 stores located in South Africa, Namibia and Botswana.

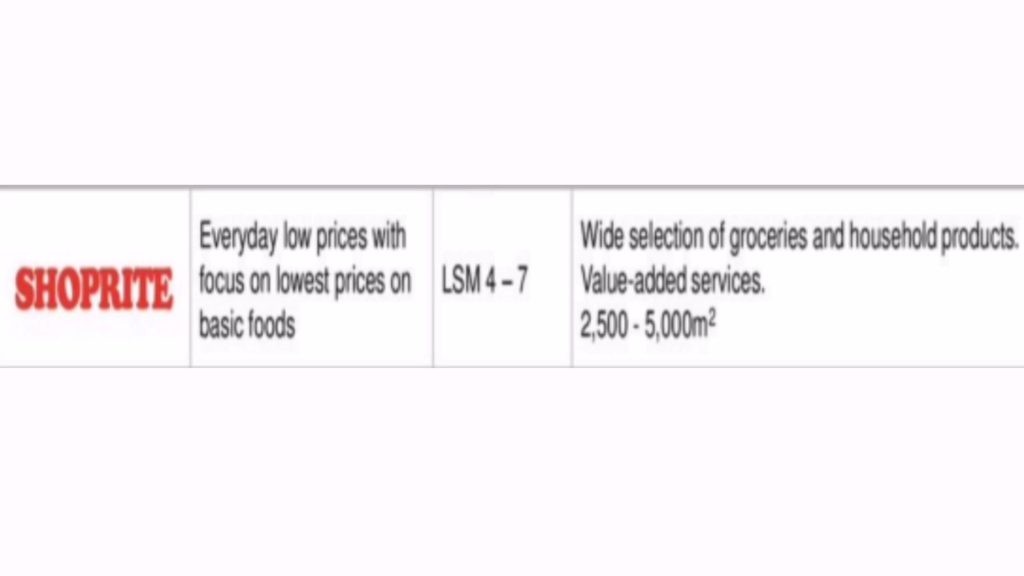

Having proved himself a master at turning around and integrating acquisitions, Whitey looked at the chess board and came up with a strategy of how he can dominate the retail industry of South Africa by emphasizing more towards organic growth and lifting margins. A major step in this regard after the OK acquisition was a focused segmentation of the group’s brands based on clear LSM target markets.

He then set a target of three months to identify which sites suited which brands best.

Shoprite was positioned to serve the LSM 4 to 7 segment while Checkers underwent the most significant metamorphosis to position itself in the top-end LSM 8 to 10 market segment.

According to Whitey, it took his team about four years to reposition Checkers to compete head-on with Pick n Pay and Woolworths but the strategy continues to pay off handsomely to this day.

To complete its line-up, the Shoprite Usave brand was launched in 2003 to serve the LSM 1 to 7 segment.

Following the model of European deep discount, no-frills, limited-range food retailers such as Aldi, You save was designed with a cost structure that could support a 50% reduction in gross margin and still produce excellent returns on investment.

Shoprite’s ability to launch a new brand from scratch was also greatly enhanced by its well-established strategy of in-house-managed centralised distribution. It didn’t come cheaply though, with around 14 billion rands invested in centralised distribution in the group’s first 18 years of existence. The investment has produced a well oiled logistical machine which supports a retail organisation selling billions of items per year.

The Shoprite Group entered the Quick Service Restaurant market in 1997 with the introduction of the Hungry Lion brand. Developed from a small take away outlet, the chain now boasts modern, well-designed stores with ample seating and an inescapable focus on fried chicken. The chain delivers a wide variety of quality products that offer consumers more value for money in a fast and friendly environment.

From the launch of their first store in Stellenbosch, Hungry Lion has grown into a chain of over 200 fast food outlets operating in 7 countries throughout Southern Africa. Today however, the Hungry Lion brand operates as a standalone business from Its founding company.

The Money Market counter was introduced in 1998. The main objective of the Money Market counter is to enable customers to settle more of their daily transactions in one place.

This initiative started out by giving clients the option of buying cell phone airtime and pre-paid electricity at a designated counter in the store. The original product offering has now been expanded to include money transfer products, postage stamps, water accounts, municipal rates and taxes, theatre and events bookings, telephone accounts, lottery tickets, bus tickets, flight bookings and insurance.

The overall success of the Money Market Counter initiative has been noteworthy. Shoprite estimates that more than 50% of its clients make use of the counter while in the store.

The first Medirite started trading in Checkers Hyper Brackenfell in 1999, marking the Group’s entry in the medical services and supplies industries. Today, there are more than 140 in-store dispensaries; the aim of bringing better and more affordable healthcare to the public is being realised.

Conveniently located inside selected Group Supermarkets and supported by the Group’s pharmaceutical wholesaler, Transpharm, Medirite is well positioned to meet the growing need for easily accessible and affordable healthcare. Many Medirite pharmacies are located in previously disadvantaged communities where pharmaceutical services were unavailable.

Medirite is a designated service provider and preferred partner to most medical aids, which means customers can conveniently fill their chronic and scheduled prescriptions while doing their grocery shopping. Medirite also offers wellness screenings that are covered by most medical aids.

The group launched the first standalone pharmacy store called Medirite Plus, which is a one-stop health and wellness destination with affordable and accessible products.

In 2000, Shoprite bought Freshmark Systems, a procurement & inventory management system for fresh produce. The subsidiary not only supplies fresh produce to Group stores within South Africa, but also to most of its outlets in other parts of the continent.

Freshmark operates its own network of distribution centres and refridgerated trucks; negotiates production contracts with thousands of large and small-scale farmers in a number of countries; sources specialty fruit and vegetables on international markets, and plays a key role in equipping emerging farmers with the knowledge and skills to produce and meet international Global G.A.P, a farm assurance program, translating consumer requirements into Good Agricultural Practice.

The first Shoprite LiquorShop opened in 2005, Checkers LiquorShop soon followed. The Shoprite-Checkers LiquorShop chain has since added over 500 stores in South Africa, Botswana, Mozambique, Lesotho and Namibia.

These stores are positioned adjacent or near Group Supermarkets and offer a range of local and international products at low supermarket prices. These stores offer a range of local favourites, from ice-cold beers to branded whiskies as part of its House of Fine Whisky selection, and premium spirits.

In late 2021, the group introduced an online bottle store, LiquorShop Online, selling more than 3 000 drinks and accessories at supermarket prices, and offering nationwide home delivery.

After realising the majority of its customers were purchasing travel tickets in stores, Shoprite added ticking to its group of companies through the acquisition of Computicket and Computicket travel from Media24 in 2005. The brand is the largest provider of ticketing services in South Africa and has an extended footprint in key African countries.

Computicket operates in every Checkers and Shoprite Supermarket and Hyper store, selected Usave and House & Home stores, as well as freestanding outlets.

The available ticketing solutions cater for a variety of requirements ranging from theatre events, concerts, festivals and sporting events, to travel which includes bus and flight tickets, car rental and accommodation. A range of business solutions such as stadium management, capacity management, travel management and access control are also available.

In 2009, the Shoprite Group acquired Transpharm Pharmaceutical Wholesalers. Established by a group of retail pharmacists in 1970, Transpharm distributes a wide range of pharmaceutical products and surgical equipment to MediRite pharmacies, as well as other pharmacies, hospitals, clinics, dispensing doctors and veterinary surgeons across South Africa.

There’s a famous saying by Bidvest founder Brian Joffe, where he says “Bidvest does not partake in recessions”. That same line applies to Shoprite. Under Whitey Basson, the company did not partake in recessions. In bad times they did good, in good times they did great. The world was in a global recession in 2009 but Shoprite produced an 11.9% growth in sales totalling 33 billion rands & trading profit was up 17.5% to R1.6 billion.

The 2010s brought more growth for Shoprite. In 2011, the company acquired Metcash Cash & Carry which operated 150 stores under the Friendly & 7Eleven brands, those stores were integrated into the OK Franchise.

In the same year, In 2011, the group started Red Star Wholesale and Catering Services, formerly known as Checkers Food Services, to provide a food delivery service to customers in the catering and hospitality industries.

With an extended range of more than 8,000 products and a new e-commerce ordering platform, Red Star Wholesale services thousands of hospitality and catering businesses.

Products available for order include fresh fruit & vegetables, cleaning & packaging materials, quality butchery meat, frozen foods, groceries, beverages including liquor and wine as well as chilled perishables.

The services are available to chefs, restaurants, hotels, hostels, guesthouses, caterers, redistributors, industrial kitchens and the everyday consumer.

According to Whitey, when Walmart first entered South Africa in 2011, the retail conglomerate met with him to acquire his Shoprite but he used clever tricks to derail Walmart’s plan to takeover the retail scenes of the country.

Whitey was concerned that Walmart would acquire Pick n Pay if they could not get their hands on Shoprite. With Walmart’s deep pockets and exceptional retail expertise, they could crush all other retailers in South Africa.

At the time, Walmart had over 9,000 retail stores under 69 different brands and banners in 28 countries. It had annual sales of $419 billion and employed more than 2 million associates worldwide. It was on an expansion drive, which scared most retailers who had to compete against them.

Whitey diverted Walmart’s attention away from Pick n Pay and convinced them to buy Massmart instead. It helped that he knew former Massmart CEO Mark Lamberti well.

He worked with Walmart and Lamberti to facilitate the Massmart acquisition, which was concluded in late 2011.

To limit Walmart’s ability to use its financial muscle and retail expertise to crush Shoprite, Whitey ensured Massmart remained listed on the Johannesburg Stock Exchange. He knew that by being listed on JSE, Massmart couldn’t make very aggressive business decisions. Ensuring that Massmart remained listed forced them to report back to their shareholders and limit the freedom with which they operated.

As a result, the Walmart ran Massmart has faced headwinds operating in South Africa.

By 2012, Shoprite became the 92nd largest retailer in the world & the largest in Africa. Whitey doubled down on the Africa expansion strategy opening a store in Kinshasa, DRC.

2013 was the start of a tough couple of years in their Rest of Africa markets, which saw Shoprite exiting a couple of markets. This did not slow down the group opening a record 13 stores in a day, passing 1 billion transactions in a year at the rate of serving 83 customers per second & revenue topping R130 billion in 2016.

Unfortunately, 2016 would be Whitey Basson’s last year at the helm of Shoprite. He had served as CEO for 38 years and grew tired after being with the company for so long. The business was so large and there were so many issues that took up too much of his time. He retired at the end of December 2016 with a golden handshake of R1 billion.

He was succeeded by Pieter Engelbrecht, who had been with the group for 17 years serving different roles under the guidance of Whitey Basson.

When Engelbrecht took over, he chose Joseph Brönn to lead as the Chief Business Officer, Brönn’s strategic mandate was to personally drive new projects in IT, data management and sustainability for the group.

Under their leadership, the Group repositioned the business’ mission to to be ‘Africa’s most affordable, accessible and innovative retailer’, and set about making that idea a reality.

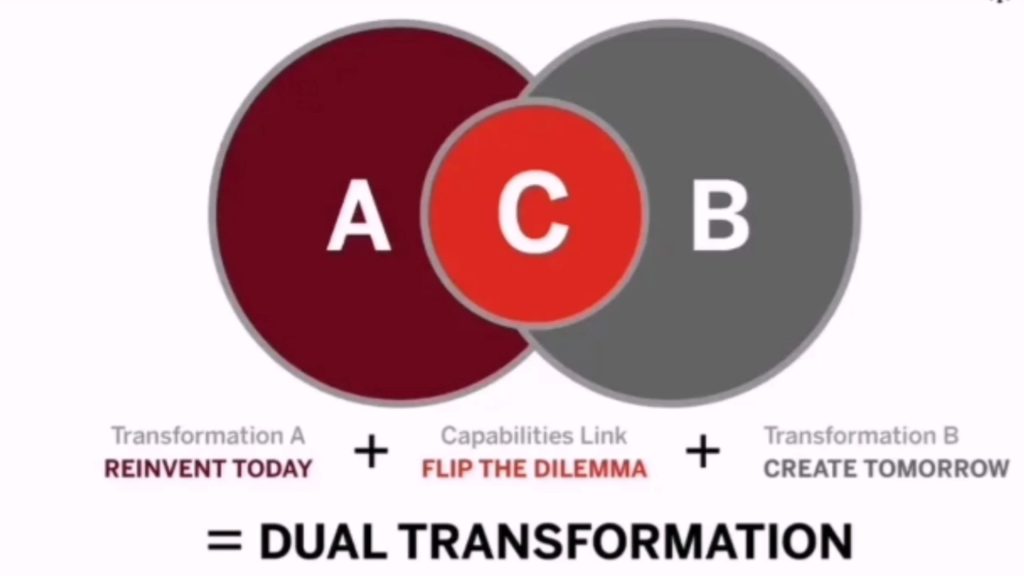

The specific strategy that Shoprite adopted is a very clever one for a big retailer. In a nutshell, they have purposefully elected to innovate the business by pursuing what is best described as a ‘duel transformation’.

Duel transformations happen when the core business is incrementally improved over time, improving efficiencies and profitability, while at the same time riskier, new innovations and models are created and brought to market by dedicated, but separate business units, and allowed the space to find their own footing in the marketplace.

In Shoprite’s case, a lot of their cutting-edge innovations that they bring to market are being produced by a separate strategic business unit called Shoprite X which is run under the guidance of Neil Schreuder, Chief Strategy Officer of the Shoprite Group.

As part of advancing Shoprite X, the group created an ecosystem of partnerships.

Apart from a dramatic increase in the prevalence of their own brand labels, which unlocks higher margins for the group, Shoprite have also signed some very clever partnership deals with luxury consumer brands like Starbucks, Kauai and Krispy Kreme; brands that attract the market that they are trying to steal from their competitors.

Even though these brands are just partners, in combination with their supermarket platforms, they are creating a cost-effective brand differentiator by simply building a relationship with other category leaders.

Without making a huge song and dance about it, the group have strategically redefined what business they are in.

They no longer appear to classify themselves as a supermarket, but rather a community platform and ecosystem on which they can create compelling retail experiences and offerings that draw a desirable buying audience.

Instead of trying to own every part of the ecosystem, they’re creating the conditions under which the right kind of people will be attracted to what they have to offer.

This open, multiplier effect is in sharp contrast to how most business is conducted in South Africa, so clearly somebody has done a significant amount of lateral thinking over there, challenging their own assumptions as to how best to build a future-focused supermarket business.

The group launched its first Checkers FreshX store in 2017 in a bid to attract more affluent customers and grab market share from upmarket retailer Woolworths. The large stores cater for high-end shopping, featuring sushi belts, chocolate counters, spacious temperature-controlled wine cellars and artisanal breads.

Customers can also access exclusive private label brands such as Forage & Feast and Simple Truth, a meat market with free-range chicken and restaurant-quality steak.

Unlike traditional Checkers stores, the FreshX concept stores feature more upmarket furniture and signage – including benches and tables for customers to test samples.

Shoprite Group has since then launched over 68 FreshX retailer supermarkets around the country, and plans to open more in the next few years.

Under Engelbrecht, the group increased revenue and market share. And also became the 86th largest retailer in the world. Towards the end of 2019, the company started to prioritise value-added services in South Africa.

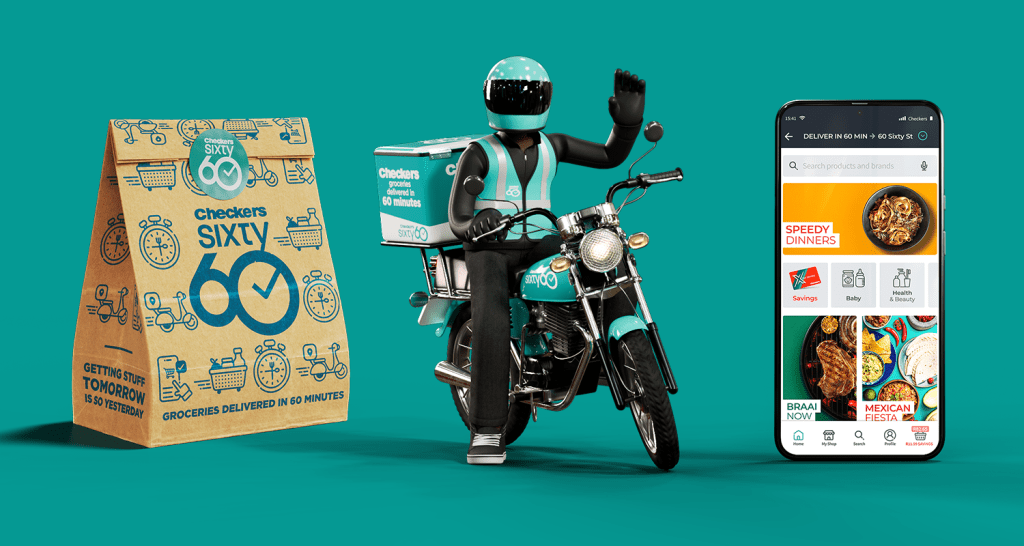

In November, the group launched Checkers Sixty60, offering delivery in 60 minutes at a flat fee of R35. The app has since been downloaded more than 3.1 million times and the service now delivers in more than 400 locations nationally. Sixty60 continues to grow, with sales surging 87% in the most recent reporting period to December 2022, on top of 250% in the prior period.

The Success of Checkers Sixty60 led the group to strengthen the relationship with the brand’s delivery partner, RTT Group, in late 2021. Under terms of the agreement, the RTT Group’s on-demand business was transferred into a new company, Pingo Delivery, in which Shoprite Checkers has a 50% shareholding.

The joint venture will advance the technology, learnings and intellectual property created to enable development in the digital and customer experience in line with Shoprite’s ecommerce plans.

The on-demand marketplace has exploded over the last five years in South Africa. Using technology along with the variety of services and the networks that the RTT group brings, Pingo allows its clients to connect suppliers with consumers, through access to and fulfilment of goods and services.

During the same period, the group also launched a loyalty card programme called Checkers Xtra Savings card which signed over 1 million people in 72 hours and 5 million people within the first 6 months. In late 2020, the group launched the Xtra savings card to Shoprite customers, signing up 1 million people within 72 hours at a rate of 400 people a minute.

Armed with a 40 year+ distribution system that allows the company to gain instant scale of any product or service, the group successfully launched the first Shoprite K’nect at the Delft Mall in Cape Town in May 2019, additional stores were opened as time went by.

Each K’nect store includes specialist tills for those transactions that take a little longer, including money transfers, tickets for travel & events, insurance and mobile – devices and accessories. Express tills cater for quick transactions, including bill payments, airtime & data, as well as buying electricity and Lotto tickets.

K’nect Mobile launched in March 2021, adding a new revenue stream to the Group’s financial services and cellular division.

In early 2020, the group created a new business venture called Rainmaker Media, a digital marketing agency that creates strategies for brands who want to leverage the scale of the Shoprite physical and digital platform assets to improve the accuracy and performance of their sales.

For a fee, the Group are able to promote, analyse, measure and improve the sales performance of brands and products that sign up for the service.

By leveraging the customer insights that they generate from their operations, they are able to create additional revenue streams outside of their core supermarket operations as well as differentiate themselves as a holistic digital business, rather than just a retailer with shelves to fill.

In August 2020, Shoprite launched a free transactional account called Money Market Account to give customers more ways to save, send or spend their money.

The service was developed into a fully-fledged transactional bank account two years later through a partnership with Grindrod bank, the first offering of its kind by a South African retailer.

With this new venture, the company aimed to make the banking process and onboarding simple, with no physical forms – everything is digital. Customers are also not restricted to banking hours, but rather retail hours seven days a week in order to withdraw cash in-stores and be able to send money to others.

To further exploit the R7 billion pet sector in South Africa, the Shoprite Group first launched Checkers Pet Insurance in 2020, underwritten by outsurance.

Insurance options range from R89 to R245 per month depending on whether it is accidental cover for injuries, core cover for injuries and illnesses requiring admission to veterinary practices or comprehensive cover covering accidents, illnesses, vet visits and routine care such as vaccines, sterilisation, dental scaling and deworming.

The following year, this was followed by standalone pet store called Petshop Science. The brand offers a broad selection of more than 2 thousand pet-related products. These include food, treats, toys, and more from premium brands like Hills, Montego, Dog’s Life, Eukanuba, Ultra Dog, Royal Canin, Rogz and Nandoe.

As of 2023, Petshop Science has over 22 physical stores across the country.

The group expanded its ecommerce presence by taking the Petshop Science brand online. The site isn’t just convenient for delivery reasons. Owners can create a number of profiles for their pets, including the pet’s age, type, and breed. The site shows customised recommendations for each pet, like foods and toys best suited for the animal. If a pet becomes a loyal customer, the site will send specialised deals, tailored to the pet specifically.

In November 2021, the Shoprite Group opened its new Checkers Little Me standalone baby store. The Little Me offering was already existing in some Checkers supermarkets but the group decided to go with a one-stop destination.

The first standalone store, situated in Drakenstein, carries a range of baby essentials across different brands and a maternity wear line, Miyu, made exclusively for Little Me. It was designed and manufactured by a local maternity wear brand, Cherry Melon.

The Little Me dedicated stores came as Checkers rivals also fought for their share of the South African baby market pie which sees over 1.2 million babies born annually.

A month prior to the first standalone Little Me, Clicks had opened its second Clicks Baby in a move that helped expand its baby category.

Beauty and pharmacy retailer, Dis-Chem, had also made significant inroads in the baby retail segment with its acquisition of Baby City, in which it introduced baby and mum wellness clinic services.

The retailer also acquired another baby retailer, Baby Boom, which has boosted its baby offering.

Toys R Us South Africa also strengthened its baby offering with the addition of baby wellness clinics called Babies R Us.

The Mr Price Group also entered the baby chat in late 2022 by launching several standalone stores called Mr Price Baby across the country, offering customers a variety of essentials for babies, toddlers, and kids up to seven years old..

To strengthen its position against its rivals in the baby market, Checkers launched its eighth Little Me store in May 2023 at the Burgundy Square Shopping Centre in Milnerton, Cape Town.

Little Me offers an extensive range of baby and toddler products all under one roof.

From essentials such as nappies to big-ticket items like car seats and strollers, Little Me has it all, including expert sales assistants to help customers make the best choices for their little ones.

The Shoprite group continued with aggressively rolling out standalone stores across various categories by launching Checkers Outdoor, an outdoor standalone store packed with premium and affordable camping and braai accessories as well as high-tech gadgets for nature enthusiasts, all conveniently located under one roof.

The first standalone Checkers Outdoor opened in Hermanus in April 2022, followed by a second one in Noordhoek in July 2022. Four months later, the third one was opened in Oceans Mall in Umhlanga.

With products from premium brands including Weber, Traeger, Big Green Egg, Garmin, Coleman and Victorinox, the specialist Outdoor stores offer everything from sleeping bags to tents, camping chairs, heaters, braais and grills, torches and headlamps and a large variety of cooler bags.

In early 2023, the group launched its first standalone clothing store in Cape Town Called UNIQ, eight more stores were opened the following Monday in different parts of the country.

The company described the UNIQ brand as premium basics and catering to the whole family, with a focus on simplicity, comfort, superior fabrics and value. It is emphasising durability and comfort and clearly taking direct aim at Woolworths and Pick n Pay, both of which have significant clothing ranges

While the Shoprite Group has traditionally been associated with its dominant position in the middle to lower end of the market, Unique however, offers a range of different clothing in a higher price category.

One thing that makes UNIQ stand out from the crowd is the self checkout technology the Shoprite Group has implemented in the new clothing store.

The store not only doesn’t allow cash payments but also doesn’t have cashiers, customers can only use the self-checkout machines.

The group seems to be doing away with cash payments, in July of this year they introduced the OK Urban store in Sonstraal, Durbanville which also like Unique, doesn’t allow cash payments.

The OK Urban store is Shoprite’s strategic move into the high-end market, presenting a sophisticated alternative to the local suburban corner store. With a strong emphasis on convenience, freshness and an urban lifestyle, this new store challenges traditional retail and offers a glimpse into the future of the brand.

On top of wanting to do away with cash payments, the Shoprite group also seems to want to do away with tills and counters in stores.

The company has been testing several new concepts through the Shoprite X programme. One of the new concepts currently being trialled is Checkers Rush, an automated, cashless, no queues, no checkout, and no waiting concept store.

Located at the ShopriteX offices in Brackenfell, Checkers Rush allows employees to grab products and walk out without paying at a till. The trial store only has 40 products and allows employees to take products and walk out without paying at a checkout counter.

According to the group, this was possible using advanced AI-camera technology to identify the products being taken off the shelves. Checkers Rush then bills the users’ bank cards upon exit.

Although the cashierless stores has been adopted in other parts of the world like the US with Amazon Go and UAE with Carrefour City plus, it has yet to take off in the African continent and if it does, the Shoprite Group will likely be a the first retailer to introduce it.

However, even if the Checkers Rush concept store does finally come to life, it will be difficult for the group to roll it out nationally because Unions have already warned about its future possible demise due to the massive unemployment the country is facing.

Although the Shoprite group has had an upward trajectory for most of its existence, the failures and setbacks do exist in the portfolio, especially when the company tried expanding outside South Africa.

In 2021, the retail giant added Uganda to its list of African exits after selling its business in Nigeria of 15 years and closing Kenyan stores in March.

For a long time the group had been the poster child for African expansion. As early as 1990 after it began its foray into the rest of the continent by opening an outlet in neighbouring Namibia’s capital Windhoek. By December 2005, Shoprite had entered Nigeria in West Africa, with a supermarket in a new shopping centre in Lagos. Now Shoprite’s footprint on the continent has been reduced to just 10 countries.

To be fair though, many South African retailers have also retreated from the continent, specifically Nigeria. Mr Price closed its last store there in early 2021, stating difficulties doing business because of inflation, volatility, and weak economic growth. Truworths pulled out of Nigeria in 2016 and Woolworths left as far back as 2011, both citing complex supply-chain processes, high duties, and the high cost of rent.

The group pulled out of India too, after opening a wholesale business around 2004 in anticipation of legislative changes to allow foreign ownership. However, these changes never came and Shoprite was forced to exit the Asian markets in 2010.

Like many other South African retailers, Load-shedding has cost the Shoprite Group millions of Rands. Load-shedding affects retailers in many ways, but two effects stand out.

The first impact is less foot traffic during load-shedding. When a power cut occurs, a retail store becomes an unattractive shopping environment for customers, leading to retailers losing potential customers during those periods. The second and likey more significant is diesel expenditure. In 2022, the group’s supermarket business delivered a 17.5% increase in sales to R85.1 billion. However, profit growth was hit by relentless loadshedding which cost the retailer over 560 million Rands.

This expenditure has significantly increased company’s operating costs and also cut its profit margins. Although the group announced its renewable energy strategy as part of its plans to go off-grid, the plan will unfortunately take some time to bear fruits.

Shoprite being Africa’s largest supermarket retailer made it a prime target for the rioters and looters who went rampage mode in July 2021 after the jailing of former president Jacob Zuma.

The company suffered over 1.25 billion rands in damage after 135 of its supermarkets and 54 LiquorShops were severely impacted during the looting spree in KZN and some parts of Gauteng.

But as the Shoprite group has shown time and time again, you can never keep a good man down, the company reopened most of the looted stores back into operation since the incident occurred.

Right now you’re probably wondering, what’s next for Africa’s largest food retailer? Well the answer can be described in Two words: A LOT

Presenting the company’s annual results in September 2022, CEO Pieter Engelbrecht announced plans to add hundreds of new stores in 2023 and also build a new 85 thousand square metre campus in Johannesburg. This plus its Shoprite X projects and community based initiatives, the group certainly has more up in its sleeves and we’re eagerly waiting to see what’s in the bag.

Get South Africa’s latest entrepreneurial or business success stories delivered right to your inbox — Sign up to Entrepreneur Hub SA’s newsletter today

eBook: 50 South African Entrepreneurs Reveal HOW THEY MADE IT